Summary Report Method

POST

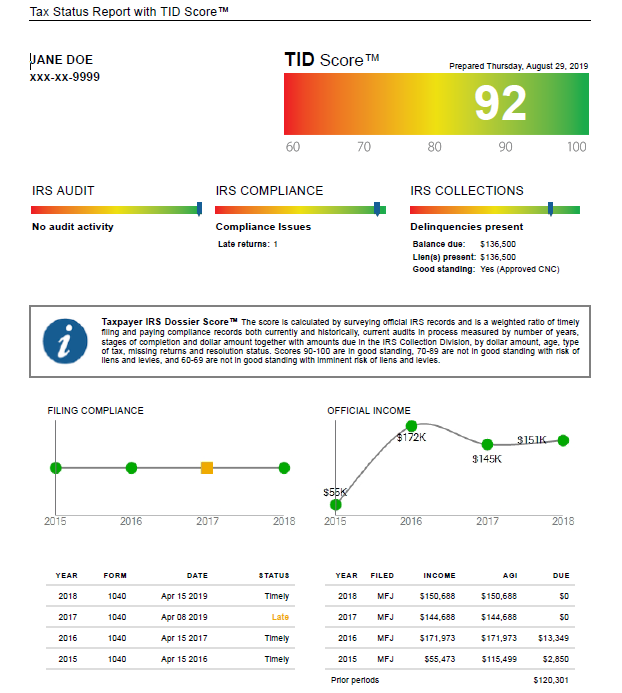

The SUMMARYREPORT method returns a summary, in PDF format, of all relevent data points that create a tax profile of the individual or business, based on what

the IRS knows. The report contains a color-coded score of where the taxpayer is at in regard to whether or not the IRS is about to take action against the

taxpayer:

- Green - taxpayer is in good standing and no action is required on their part.

- Yellow - taxpayer has some issues that need to be resolved eventually, but, at the moment, they are not major.

- Red - taxpayer will be pursued by the IRS at anytime and if the problems are not addressed quickly, a levy or lien is imminent

This score is based on three categories the IRS looks at to determine action. They are Audit, Compliance, and Collections.

- Audit - What the IRS knows disagrees with the form the taxpayer sent in. This can trigger an audit.

- Complience - Has the taxpayer filed everyyear? If a business, are all payroll taxes up to date for each quarter?

- Collection - Does the taxpayer owe taxes and have they made payments towards their balance?

The report also details filing history (filed or missed by year), income history, balance(s) owed and if there are any

outstanding liens. The following is a sample of the report:

Request Path

Submit all summaryreport requests to the following path.

You will obtain the API endpoint after you register on your account page.

Query String Parameters

Query string parameters are not supported on this method.

/SummaryReport Request

application/json

This method uses the Tax Identification Number (TIN) for an individual (SSN) or Business (EIN) to retrieve all relevant tax data points and

summerizes them in a report.

Attributes

-

companyId*

The company Id of the company this call is on behalf of. If the call is not on behalf of another company, then the registered company Id

TaxStatus assigned during the registration process (used in the euid field in the header.

-

tin*

9-digit tax id (no spaces or hypens) of the individual (SSN) or business (EIN)

-

isCompany*

Zero (0) if tin is an SSN or one (1) if tin is an EIN

-

lastNameOrBusiness*

Last name of taxpayer or name of business

Example call request body for the summaryreport method

{

"companyId":"enco45100",

"tin":"222222222",

"isCompany": 0,

"lastNameOrBusiness":"Smith"

}

Response Body

application/json

The following is a list of all possible fields. NULL fields are not returned.

Attributes

-

TIN

The TIN sent in the request

-

LastOrBusiness

The last name of the individual or business name sent in the request

-

Report

A base-64 string of the report file in PDF format

Example response body for the summaryreport method

{

"TIN": "XXXXX2222",

"LastNameOrBusiness": "Samprez",

"Report": "base64 string of file"

}

Example response when taxpayer is not in the system.

{"message":"Taxpayer not found"}

The possible reponse codes are below.

Response Codes

| HTTP Status Code |

Description |

Explanation |

| 200 |

Accepted/OK |

The request has been accepted with no issues |

| 400 |

Bad Request |

You are missing some required fields or the Json in the body is missing or malformed |

| 403 |

Forbidden |

You do not have authorization to make this call. Possibly your comapany Id is invalid or you

are calling on behalf of a company with which you dont have authority. |